ESG | ENVIRONMENTAL | SOCIAL | GOVERNANCE |

HISTORY | FUTURE

ESG: Environmental Social Governance

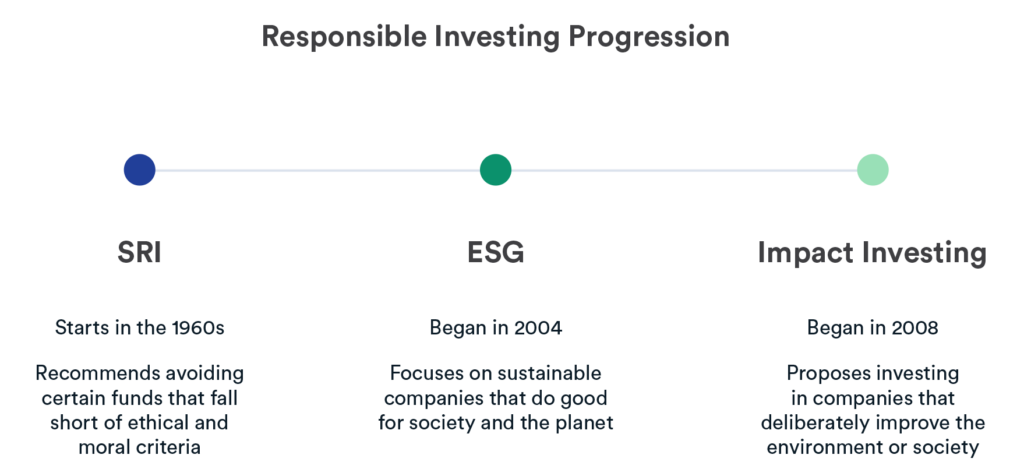

In 2004, former United Nations Secretary-General Kofi Annan penned a powerful letter to 55 finance and asset management CEOs around the world, calling on them to explore the role they play in building a more sustainable world for future generations. He asked these international financial leaders and investment professionals to adopt and embrace environmental, social, and governance (ESG) factors into their investment practices and corporate decision making — to connect investors with helping to solve some of the most critical and complex global issues we face today. Although his vision wasn’t initially accepted by investment managers, Annan’s letter eventually resulted in the Principles for Responsible Investments (PRI) initiative, and an alliance of more than 2,000 financial management companies — like BlackRock and JP Morgan — that committed to report annually on their responsible investment portfolios.

Two years later Annan, backed by the strength of the UN, launched the PRI initiative at the New York Stock Exchange. Today, the PRI is a thriving framework of principles for constructing a global financial system that is both conscientious and sustainable, by incorporating ESG issues into investment strategies. It built the foundation for the current ESG investment movement, which began reshaping international finance long before the pandemic of 2020 and before global unrest about racial injustice and social inequality moved to the forefront of awareness and activism around the world.

Today ESG investing has progressed from a sidebar story of a nice-to-have, feel-good investment class to a front-page headline of must-have, sustainable investment process that is conscious and conscientious — one that thinks long and hard about a company’s long-term impact on society and the environment as much, if not more than, the organization’s business performance. ESG investing is integrating and embracing social and environmental issues into existing business models and strategies, or transforming them altogether, with the underlying rationale that running a responsible business will drive better investment outcomes in the long run — and that it’s possible for corporations to be successful and make a profit, but still do good in the world.

It’s possible for corporations to be successful and make a profit, but still do good in the world.

Environmental Concerns

Climate Change

In early September 2020, the temperature in Los Angeles reached 121 degrees, the hottest ever recorded in Los Angeles County, according to the National Weather Service. Climate change is happening before our eyes. Extreme weather, from wildfires and hurricanes to flooding and record-breaking temperatures, destroys infrastructure and communities and can devastate entire economies. The destructive environmental impact from climate change is driving and reshaping finance and the global economy.

Sustainability

Consumers are demanding sustainable practices from the companies they purchase from and invest in; they want to support companies that possess ethical business practices that protect air and water quality, land, and public health — and those that reduce environmental risks, and prioritize combating climate change and sustainability over profit. They’re paying attention to things that wreak havoc on our the planet, like toxic emissions, carbon footprints, pollution, hazardous materials, packaging and waste— and they’re seeking out companies with high ESG values, those with sustainable practices in place like green buildings, renewable energy, sustainable supply chains, conservation, and raw material sourcing.

Organizations that take actions to combat climate change and incorporate sustainable practices are more likely to see higher financial returns.